Making the Most of Tax Credits: Sustainable Roofing Solutions

By: Lindsay Yazel and Doug Copley of Veregy, LLC

Replacing roofs can be expensive. When facility upgrades are discussed, roof restoration is often overlooked but just as often, desperately needed. Why not turn those needed repairs into a sustainable solution that offers a payback on capital costs? With a global push for cleaner energy and rising electricity rates, solar energy continues to be an attractive solution. Pairing solar with a new roofing project can help offset the cost of the project and even provide a return on investment.

Benefits to Sustainable Roofing Solutions

- Tax incentives at the federal, state, and local levels

- Solar installations help generate 15-20 year paybacks on roofing assets

- Roofing upgrades ensure a stable and productive solar project

- Roof restoration has the potential to save money and materials versus roof replacements

Tax Incentives

Recently, the government passed the Inflation Reduction Act, new legislation that allows for an increase in the Investment Tax Credit (ITC). This includes a 30% tax credit for solar energy installations for the next ten years. On top of this ITC, solar energy systems qualify for state and local utility incentives that can often be stacked on top of one another. In some cases, these stacked credits and rebates can negate almost 70% of the costs. By bundling a solar roof installation as part of a restoration or replacement, these credits can be used to offset the cost of the roof as well as the solar.

Increasing the Return on Investment of Roof Restoration

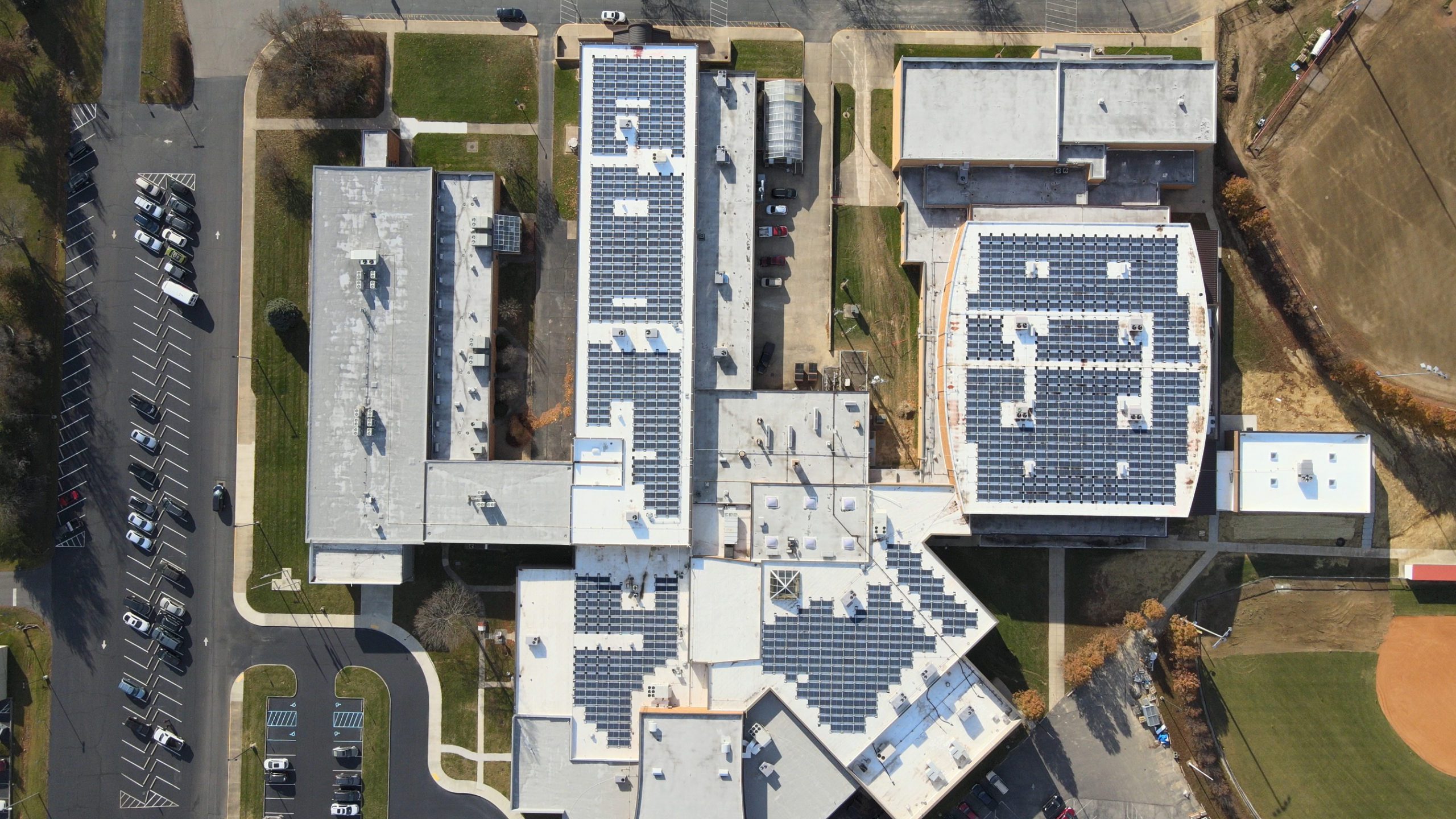

As energy rates continue to rise across the country, many operators of large facilities have begun to explore the benefits that solar can offer but often lack the space to do so. Most facilities, however, have plenty of roof real estate that could be used for large-scale power generation. By combining a solar project with roof restoration, the solar panels can be installed on a space that is properly prepped and structurally sound for the best possible outcome. Since solar panels only weigh 4-6lbs per square foot of roof space, the installation adds very little weight. An added benefit is that rooftop solar systems do not penetrate the roof itself, helping to maintain the integrity of the roof over time.

Utilizing solar energy with roof restoration is not just about ITCs either. Once installed, solar generation is able to supply significant amounts of power, offsetting the continuously rising energy costs. Nationally, inflation has caused the average utility rate to jump as high as 30% in some areas, according to the US Bureau of Labor Statistics. This, coupled with the push for cleaner energy, has caused solar projects to increase by an average of 33% each year over the last decade.1

Roof Restoration vs. Roof Replacement

A roof replacement is not only a costly endeavor but a time-consuming one that can often result in downtime; another driver of costs. Depending on the roof infrastructure, entire sections of the roof must be removed and replaced entirely, the impact to both the business and the environment can be significant. In many cases, however, a full replacement is not required, instead, a restoration of the existing roof is an adequate solution. Instead of replacing all the components of the roof, an audit and inspection by professional engineers are completed, and only those parts of the underlying structure that require it are replaced.

On average, a roof restoration is 40% less expensive than a complete roof replacement. Not only do the cost savings add up, but restoration is a much more sustainable option, sparing the removal of old material that must be landfilled and a significant reduction in the materials needed to rebuild. This doubles the positive environmental impact of solar roof restoration by both reducing materials and waste and by generating clean energy for decades to come.

“The experience we had with Veregy and Tremco for our roofing and solar projects at Madison Consolidated was unique and highly successful. By doing a roof restoration instead of a total roof replacement, we saved thousands of dollars up front on the roofs that had been leaking for years. We then were able to put those roofs to work by installing solar panels on top of them. So instead of sinking hundreds of thousands of dollars into a roof and getting to do it again in 25 years, the roof-solar combination will pay for itself (both roof and solar) within 15 years and will continue to make money for the district even after it has met its installation cost.

– Former Superintendent, Mr. Jeff Studebaker

References

- Solar Investment Tax Credit (ITC) – Solar Energy Industries Association

https://www.seia.org/initiatives/solar-investment-tax-credit-itc